GSTR 7 Return Filing, Format & Important Rules

- 25 Feb 25

- 6 mins

GSTR 7 Return Filing, Format & Important Rules

Key Takeaways

- Mandatory for TDS Deductors – GSTR-7 is essential for businesses deducting TDS under GST.

- Due Date & Penalties – File by the 10th of the next month to avoid penalties.

- No Revision Allowed – Errors must be corrected in the next return.

- Compliance Benefits – Ensures legal compliance and financial transparency.

- Simple Online Filing – File via the GST portal using DSC or EVC.

GSTR-7 return is mandatory for businesses engaged in TDS (Tax Deducted at Source) deduction. It ensures transparency between the deductor, taxpayer and the government. Taxpayers can verify whether deductors deposit the tax at source for the earlier tax period with the government through accurate filing within the due date at applicable rates for intrastate as well as interstate supplies.

Explore the process of filing a GST return using Form GSTR-7, followed by its importance, format and revision applicability here for compliance with GST laws. Ensure you adhere to the due date to avoid the imposition of penalties and interest by the government.

What Is GSTR-7?

GSTR-7 return form is used by businesses deducting TDS under GST (Goods and Services Tax). This streamlines tax deduction at source while ensuring the deposit of the correct tax amount with the government.

Entities with huge volumes of transactions with different vendors and service providers need to file this return for compliance within the GST framework. You can use the GST calculator to simplify TDS calculation for error-free sequential filing of returns.

What Is the Significance of Filing GSTR-7?

Here is the importance of filing GSTR-7:

● It confirms the deposit of deducted tax with the government.

● GSTR-7 return filing ensures compliance with Indian tax laws and the GST regulations.

● It ensures transparency in business transactions.

● Filing GSTR-7 within the specific due date ensures legal compliance, preventing adverse legal implications on businesses.

● It boosts accountability in the financial ecosystem of India.

● Timely GSTR-7 filing helps the Indian Government address fiscal deficits in the economy.

What Is the Deadline of GSTR-7?

Here are the due dates and related penalties and extensions for GSTR-7:

● Due Date: You need to file the GSTR-7 monthly return by the 10th of the next month. For instance, you need to file the GSTR-7 Form for March by the 10th of April of the same year.

● Extensions: The deadline is set by the government for timely tax collection and compliance.

● Penalties: If a deductor does not file GSTR-7 returns within the due date (late filing), the government might levy penalties which likely affect the concerned deductor's compliance status.

● Annual Reconciliation: In addition to the monthly filing of Form GSTR-7, you need an annual reconciliation statement wherein payment details including debit entry, input tax credit and refunds from the electronic cash ledger are elaborated. This helps the government departments align taxes paid with taxes payable by public sector undertakings and other necessary authorities.

What Is the GSTR-7 Format?

Here are the key parts of GSTR-7 that you need to know:

| Section | Description |

| Part A | Details of TDS |

| Part B | Adjustments made |

| Part C | Tax paid and payable |

What Is the Penalty for Non-filing of GSTR-7?

Non-filing or delayed filing of GSTR-7 likely attracts penalties as follows:

● Either a fixed amount or

● A percentage of the TDS that is supposed to be deducted

Moreover, compliance might attract adverse legal implications and additional fines imposed by the government. Further, non-compliance of businesses with tax laws significantly affects their eligibility to secure business loans and fiscal responsibilities towards the economy of the nation or the government.

How to Revise GSTR-7?

While the government does not allow provisions to revise GSTR-7 after filing, you can rectify errors in a filed GSTR-7 in the next month’s returns. This ensures accuracy and compliance with GST laws and regulations. Further, you can ensure accurate financial reporting for the tax period with timely filing of GSTR-7.

What Are the Details Required in GSTR-7?

The table below illustrates the necessary details required for filing GSTR-7:

| Particulars | Details |

| TDS Details | Details pertaining to tax deducted at the source |

| Supplier’s GSTIN | Service provider’s or vendor’s GSTIN |

| Deducted Amount | Total tax deduction from supplier payments |

| TDS Liability | TDS deduction liability |

| Penalty/Interest | Amount of interest or penalty if applicable |

Prerequisites for Filing GSTR-7

Here are the prerequisites to file GSTR-7 returns:

● Deductor's GST Identification Number (GSTIN)

● Authorised signatory to file returns

● Vendor’s details including his/her GSTIN

● Bank account details for TDS payment

● Digital signature to authenticate GSTR-7 filing

How to File GSTR-7?

Follow the steps mentioned below to file GSTR-7 returns monthly:

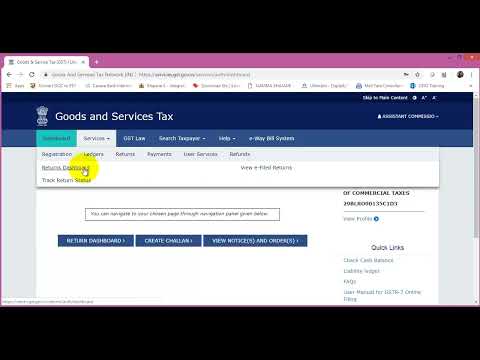

Step 1: Visit the unified GST portal and log in using valid user credentials.

Step 2: Navigate to the ‘Services’ section and choose ‘Returns’ and ‘Returns Dashboard’.

Step 3: Choose the financial year and return filing period which is the month for filing GSTR-7.

Step 4: Click on ‘Prepare Online’.

Step 5: You will be redirected to the ‘Return for Tax Deducted at Source Return’ page.

Step 6: Fill in the ‘Details of the Tax Deducted at Source’ and ‘Amendments to TDS Details’ tiles before you click on ‘Save’.

Step 7: If you need to amend details entered by the deductor proceed by selecting ‘Uploaded by Deductor Tab’. Details will auto-populate if ‘Rejected by Deductee’ on the other tab.

Step 8: To make a tax payment, click on ‘Compute Liability’ and then ‘Proceed to File’.

Step 9: Use a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) to submit the form and complete the return filing process. Ensure you choose the authorised signatory, ‘Yes’ option and DSC or EVC before submitting.

Conclusion

The GSTR-7 return due date for a return period falls on the 10th of the following month. Filing GSTR-7 returns within the due date ensures tax compliance and effective contribution to the government revenue for a registered person.

It further ensures a transparent fiscal and financial ecosystem in India. The government uses the collected tax usually for infrastructural development, healthcare and educational initiatives followed by social welfare to boost economic growth.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs